Taxes are painfully complicated and expensive. Fortunately, there are several resources that can help you calculate the best way to save on your taxes, like Section179.org.

Section 179 is a deduction that can be taken on new and used equipment, as well as software. According to Section179.org, “all businesses that purchase, finance, and/or lease less than $200,000 in new or used business equipment during tax year 2015 should qualify for the Section 179 Deduction.”

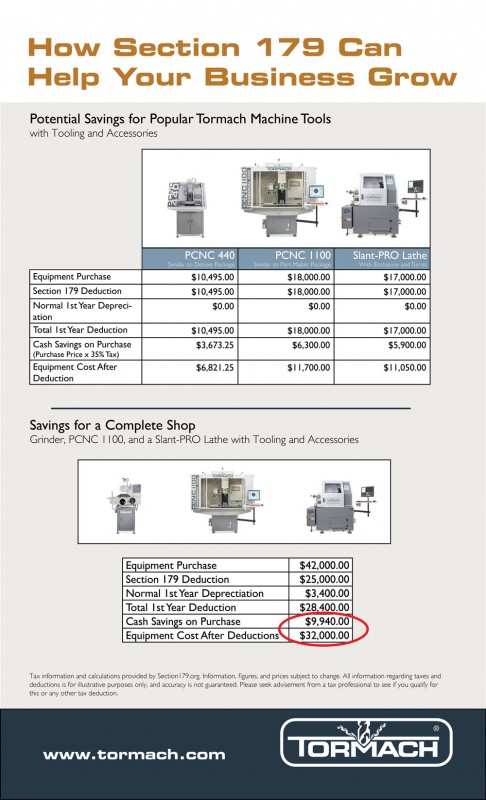

The deduction is limited $25,000 the first year, plus normal first year depreciation. Also, the spending cap on equipment is $200,000, to keep the deduction focused on small businesses. Equipment must be purchased within the tax year, so the deadline for picking up some new tools is midnight on December 31, 2015.

Again, taxes are complicated. That’s why Tormach developed this infographic to help calculate how much your Tormach shop will cost after the Section 179 Deduction.

All information regarding taxes and deductions is for illustrative purposes only, and accuracy is not guaranteed. Please seek advisement from a tax professional to see if you qualify for this or any other tax deduction.