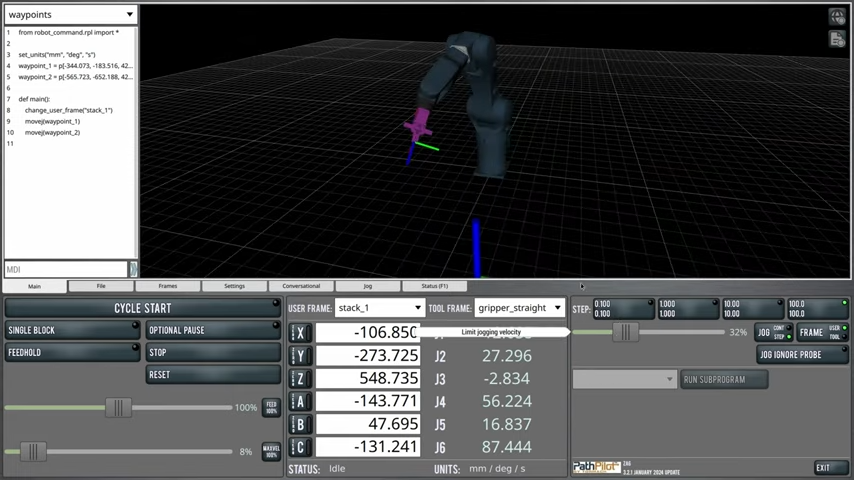

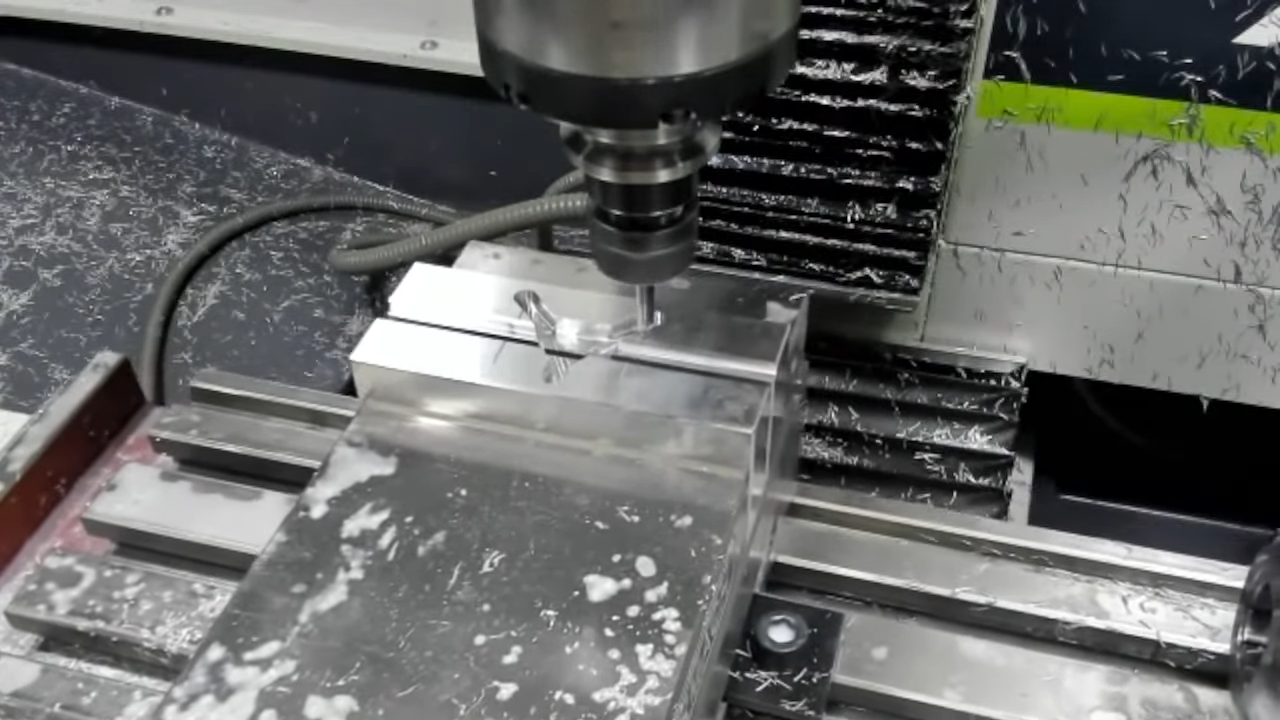

3DExperience World 2024 took place in Dallas, Texas this year and Tormach had a strong presence in the 3DExperience Playground area, where show goers got to interact with our ZA6 industrial robot, the 24R router, the 1100 MX CNC mill, and the xsTECH desktop router. Attendees who visited the Tormach area received a leather stamp (either a star or the state of Texas) which was crafted on the 1100MX mill. Our machining experts were on hand during the entire event running demos on the machines, while interacting with engineers, machinists, students, and other industry professionals. You can view photos and videos from this exciting event below.